Introduction

Forex signal copying allows traders to automatically mirror the trades of experienced professionals, often with the hope of replicating their success. While this sounds like a promising way to generate income, it raises important questions: Can you truly make a living by relying on Forex signal copying? How sustainable is this strategy over the long term? This article delves into these questions by examining industry data, user experiences, and the performance of popular signal providers.

What Is Forex Signal Copying?

Forex signal copying involves selecting a signal provider or trader and automatically executing the trades they place in your own account. This approach is facilitated by platforms that connect traders with signal providers, allowing users to allocate capital and copy trades in real-time.

How Forex Signal Copying Works

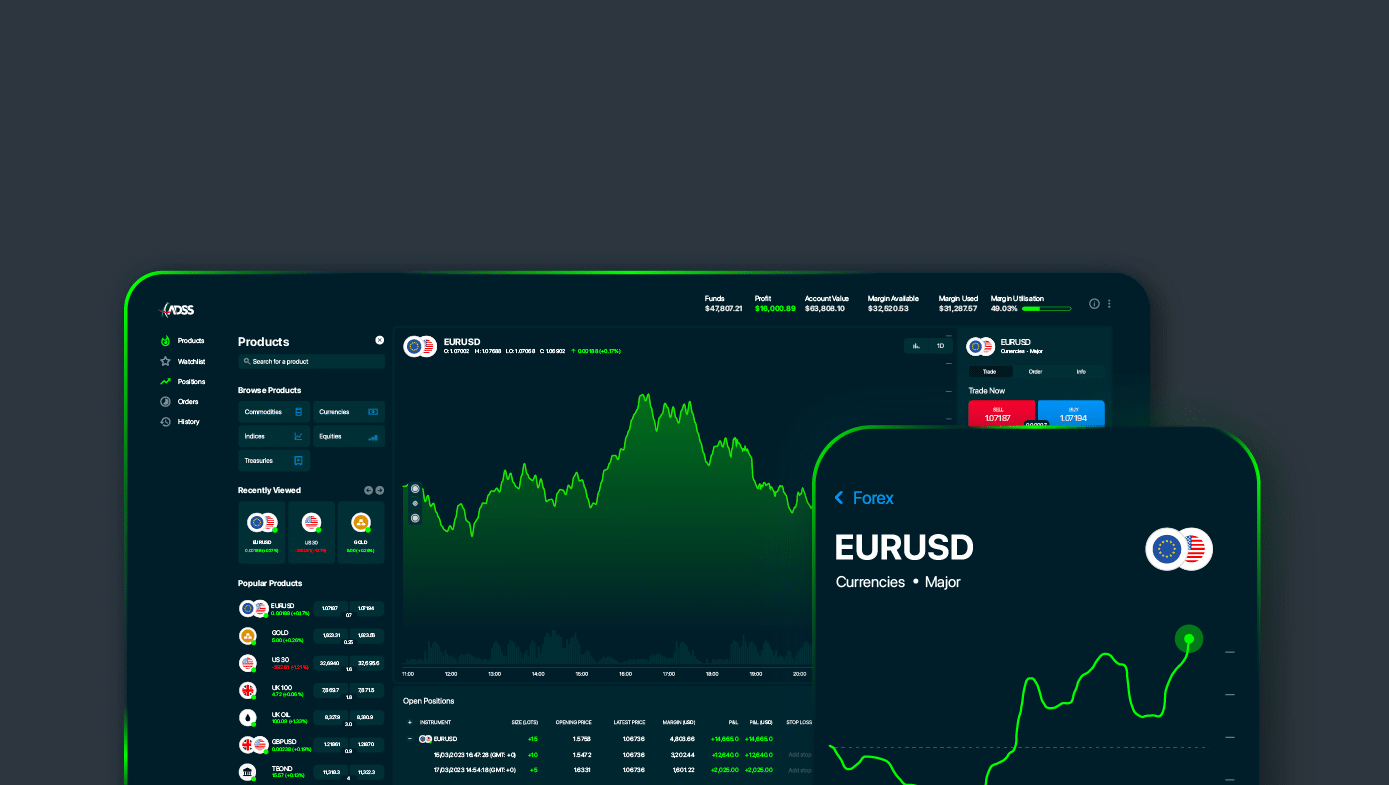

Signal copying platforms, such as Myfxbook and eToro, offer traders the opportunity to choose from a variety of successful traders or algorithmic systems to follow. Traders can set parameters such as the amount of capital to invest, risk levels, and the percentage of the provider's trades to copy. These platforms provide performance data, including win rates, average returns, drawdowns, and more, allowing users to select providers with a track record that aligns with their financial goals.

Performance of Forex Signal Copying: Can It Generate Consistent Income?

Success Rates: Success in Forex signal copying is largely dependent on the signal provider’s performance. According to industry data, top signal providers boast success rates ranging from 70% to 80%, offering traders a high probability of replicating profitable trades. Platforms like Myfxbook allow traders to view real-time data on signal providers, ensuring transparency in their performance. For instance, some traders have been able to consistently generate monthly returns between 3% and 5% by copying the trades of well-performing providers.

Monthly Returns: Research shows that traders who carefully select signal providers with proven track records can achieve monthly returns that significantly outpace traditional investments. On average, traders following top Forex signal providers can see monthly returns ranging from 10% to 15%, depending on market conditions and risk levels. However, these returns are not guaranteed, and traders must be prepared for periods of lower performance or even losses.

Long-Term Sustainability: While many traders have reported success in generating profits through signal copying, sustainability over the long term can be more challenging. The Forex market is highly volatile, and the performance of signal providers can fluctuate based on changing market conditions. According to user feedback, consistent returns are possible, but traders must regularly assess the performance of the providers they follow to avoid significant drawdowns.

Risks of Forex Signal Copying

Market Volatility: Forex trading is inherently risky due to market volatility, and signal copying does not eliminate these risks. Signal providers may experience periods of underperformance during volatile market conditions, leading to potential losses for those copying their trades. Traders must be prepared for the ups and downs of the market and ensure they are following providers with a solid risk management strategy in place.

Over-Reliance on Signal Providers: Relying solely on signal providers without understanding the underlying trading strategies can be dangerous. If a provider experiences a string of losses, traders may find themselves in a difficult position without the knowledge to make informed decisions. This makes it crucial to diversify and not place all capital in the hands of a single provider.

Drawdowns: Drawdowns are a measure of the decline in account balance from a peak before recovery. Traders copying signals must monitor drawdown levels, as high drawdowns can erode capital quickly. Many top signal providers aim to keep drawdowns below 20%, but during volatile periods, drawdowns can exceed these levels, impacting overall profitability.

User Feedback on Forex Signal Copying

Positive Feedback: Many users report positive experiences with Forex signal copying, particularly when following providers with transparent track records. For example, on platforms like Myfxbook, users can track the performance of signal providers in real-time, allowing them to make informed decisions. Some traders have achieved consistent profits by diversifying across multiple signal providers, reducing the impact of underperformance from any single source.

Challenges Faced by Traders: Not all traders have experienced success with signal copying. Some report difficulties in selecting reliable providers, noting that past performance does not always guarantee future success. Additionally, traders following high-risk signal providers may face steep losses during periods of market downturns. This highlights the importance of selecting providers with proven risk management strategies and diversified portfolios.

Trends in the Forex Signal Copying Industry

Increased Use of Algorithmic Trading: A significant trend in the signal copying industry is the rise of algorithmic trading systems. These systems use complex algorithms to generate trading signals based on historical data and real-time market movements. Automated signal providers often deliver more consistent results, particularly during periods of low market volatility. According to a report by MarketsandMarkets, the global algorithmic trading market is expected to grow by 12% annually, reflecting the growing reliance on these systems.

Growth of Social Trading Platforms: Social trading platforms, such as eToro, have made it easier for retail traders to engage in Forex signal copying. These platforms allow users to follow the trades of top traders while interacting with a community of traders, sharing insights and strategies. The transparency and accessibility of social trading platforms have attracted a large number of users, making them a popular choice for both beginners and experienced traders.

Conclusion

Forex signal copying can be a profitable venture, but it is not without its risks. Traders who carefully select providers with strong performance records and sound risk management strategies can achieve consistent profits. However, success in signal copying depends heavily on the provider’s performance, market conditions, and the trader’s ability to diversify across multiple providers.

While some traders have been able to make a living from Forex signal copying, it is important to approach this strategy with caution. The Forex market is volatile, and past performance does not guarantee future success. By staying informed, monitoring performance regularly, and managing risk effectively, traders can increase their chances of generating income through Forex signal copying.

Boost your Forex income with exclusive offers from Best Forex Rebates!