Introduction

Silver is one of the most sought-after commodities in Forex trading due to its liquidity and volatility. Whether you're a beginner looking to get started or an experienced trader seeking to refine your strategy, daily silver price forecasts and trade alerts can offer valuable insights. These signals, generated from technical analysis and market conditions, guide traders on the best times to enter or exit positions in the XAG/USD trading pair, which represents silver priced in US dollars.

This article explores the importance of daily silver signals, their role in shaping trading decisions, and how traders can use these insights to optimize their trades.

What Are Daily Silver Price Forecasts and Signals?

Daily silver price forecasts and trading signals are expert-generated recommendations that alert traders to potential trading opportunities based on current market conditions. These signals typically include key information such as:

Entry Points: The recommended price level to open a trade (buy or sell).

Exit Points: The ideal price to close a trade and secure profits.

Stop Loss: A predefined price at which to automatically exit a losing trade to limit losses.

Take Profit: The target price to close a trade and lock in gains.

These signals are based on technical indicators such as moving averages, Relative Strength Index (RSI), and Fibonacci retracement levels. By relying on these signals, traders can make informed decisions without the need for constant monitoring of market data.

Industry Trends: Increased Demand for Precious Metals

The demand for precious metals like silver has been steadily rising, driven by industrial use and economic uncertainty. According to data from the World Silver Survey, the demand for silver increased by 19% in 2023, largely due to its industrial applications and role as a store of value during inflationary periods.

With silver’s increased demand, traders are turning to daily forecasts and signals to better navigate the fluctuations in the silver market. The XAG/USD trading pair is highly responsive to global events such as changes in monetary policy, inflation, and geopolitical tensions, making accurate signals even more valuable.

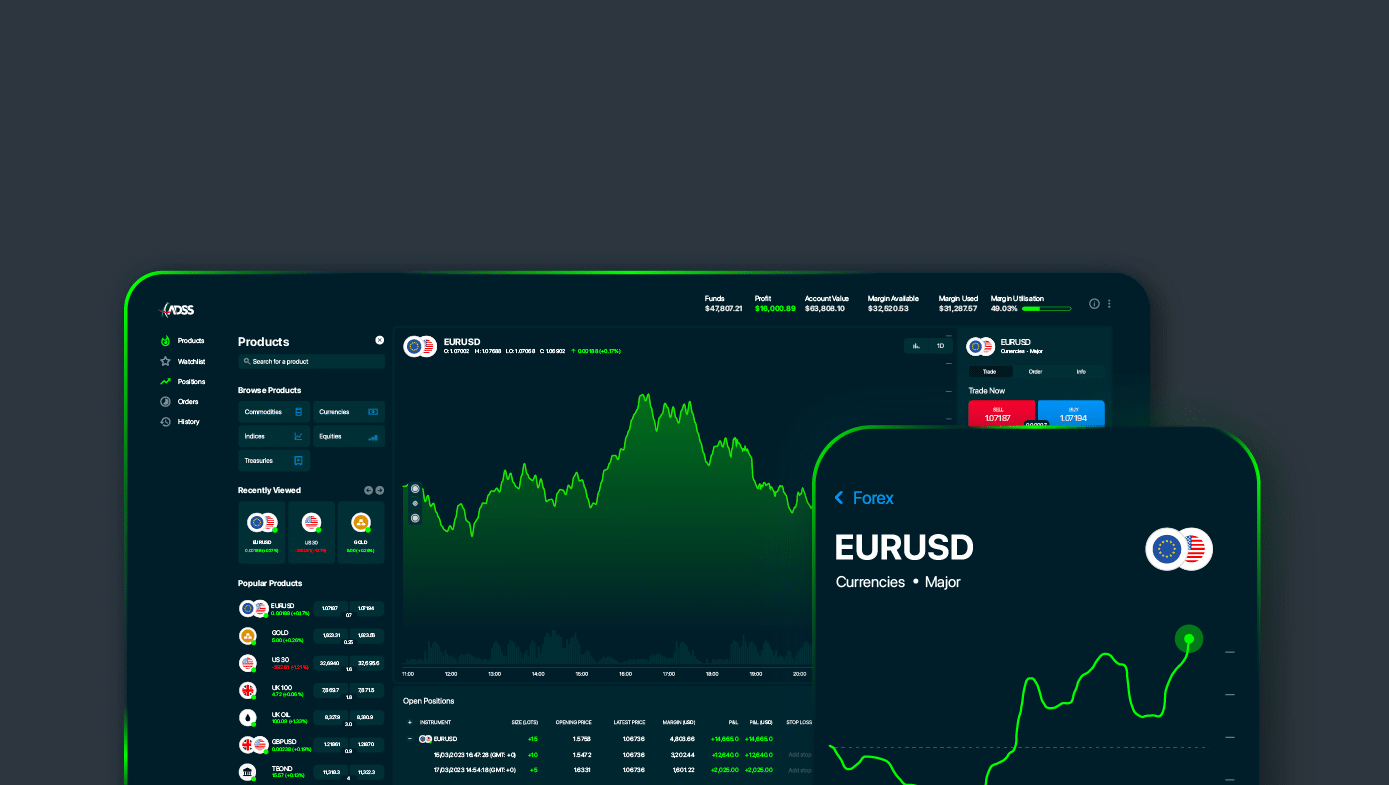

Another emerging trend is the growing use of mobile apps for receiving real-time trading signals. With over 75% of traders using mobile devices to access trading platforms, the delivery of daily silver trade alerts has become more immediate and actionable, allowing traders to capitalize on short-term price movements quickly.

Benefits of Using Daily Silver Signals

Real-Time Alerts

In the fast-moving silver market, real-time notifications can make a significant difference. Daily silver signals ensure that traders are updated with the latest entry and exit points, helping them execute trades at optimal times. These alerts allow traders to respond quickly to market changes, which is particularly useful for scalping or day trading strategies.Risk Management

Daily silver signals come with stop-loss and take-profit levels, which are essential for minimizing risk. By setting clear boundaries for each trade, traders can protect their capital from sudden market swings. This risk management strategy is critical in the silver market, known for its unpredictable price movements.Save Time with Pre-Analyzed Data

Analyzing silver’s price trends and market movements can be time-consuming. Daily signals simplify the process by offering pre-analyzed, actionable data. Instead of spending hours on technical analysis, traders can rely on signals generated from expert insights, saving valuable time while still making informed decisions.Improved Accuracy

Daily forecasts and signals are based on advanced technical analysis, using multiple indicators to predict price movements. This method increases the accuracy of trades, reducing the guesswork involved in manual trading. Many traders report higher success rates when incorporating daily signals into their strategy.

Reliable Sources of Silver Trade Alerts

When choosing a reliable source for daily silver price forecasts and trade alerts, it's important to select a platform that offers accuracy, timeliness, and comprehensive analysis. Here are a few reputable providers of silver trading signals:

CentralCharts

CentralCharts offers a detailed platform with a focus on precious metals, including silver. Their trading signals are generated from advanced algorithms and expert technical analysis, providing accurate entry and exit points for XAG/USD trades. CentralCharts also offers a wide range of analytical tools, giving traders more context for their decisions.Forex.com

Forex.com is a well-established provider of Forex and commodities signals. Their platform offers detailed silver trade alerts that are updated in real-time, helping traders stay informed about market changes. With a user-friendly interface and mobile notifications, Forex.com ensures traders never miss an opportunity.TradingView

TradingView provides comprehensive charting and signals for various commodities, including silver. The platform offers customizable alerts based on technical indicators, allowing traders to set their own parameters for receiving signals. TradingView is particularly useful for experienced traders who want more control over their signal generation.MQL5

MQL5 allows traders to follow professional signal providers and copy their trades directly. The platform includes silver trading signals, offering real-time updates and performance tracking for each signal provider. For those looking for automated strategies, MQL5 offers a valuable resource.

User Feedback and Performance

Traders who use daily silver signals report high levels of satisfaction, particularly with the accuracy and real-time nature of the alerts. Many traders appreciate the convenience of receiving signals directly on their mobile devices, enabling them to act on opportunities without being tied to a desktop platform.

A survey conducted among silver traders in 2023 revealed that over 70% of respondents saw improved trading results after incorporating daily signals into their strategies. Feedback highlighted that traders were able to reduce their risk exposure while increasing the number of successful trades by relying on these expert-generated alerts.

Additionally, users noted that combining daily silver signals with their own market analysis provided the best results, allowing them to gain a more comprehensive understanding of market trends.

Conclusion

Daily silver price forecasts, signals, and trade alerts are essential tools for navigating the volatile silver market. Whether you are a beginner or an experienced trader, these signals offer valuable insights into when to enter or exit trades, manage risk, and capitalize on short-term price movements.

Platforms like CentralCharts, Forex.com, and TradingView provide reliable and timely signals that can help traders improve their strategies and stay ahead of market fluctuations. By incorporating daily silver signals into your trading routine, you can enhance your decision-making process and boost your overall performance in the XAG/USD trading pair.

With the continued rise in demand for precious metals and the growing importance of real-time alerts, daily silver signals will remain a critical resource for traders looking to succeed in the competitive world of Forex trading.

Get rewarded for every trade with top offers from Best Forex Rebates!