Introduction

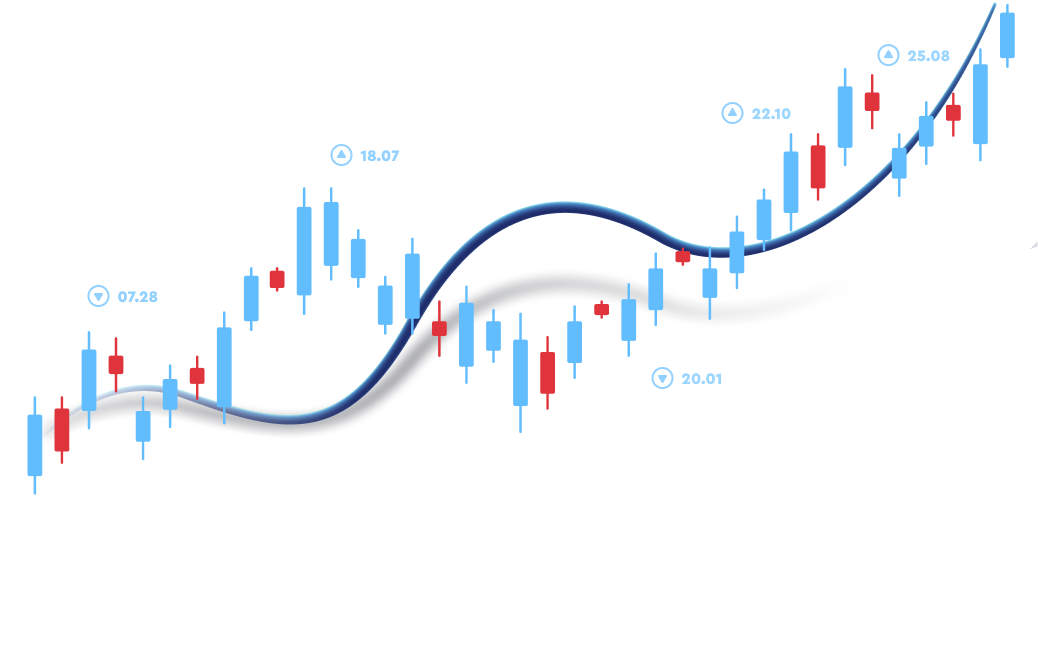

Trading signals are essential tools for forex traders, delivering timely insights into market trends and helping inform trading decisions. Valutrades MT4 provides an integrated system for accessing and managing signals, allowing users to automate and refine their trading strategies. In this article, we delve into the types of trading signals available on Valutrades MT4, analyze real market data, and explore how traders can leverage these signals for effective trading.

Understanding Trading Signals: Types and Their Functions

In the context of forex trading, signals are data-driven indications that suggest potential price movements. Valutrades MT4 offers access to a range of signals, each designed to meet specific trading goals. Here are the primary types of signals and how they function:

Buy and Sell Signals

Buy and sell signals are foundational to forex trading, offering guidance on when to enter or exit a position based on price movements and technical indicators.

Example: In February 2023, a buy signal on EUR/USD was triggered on Valutrades MT4 as the 50-day moving average crossed above the 200-day moving average, resulting in a 2% rise within the following week. This moving average crossover, also known as a “golden cross,” is a common buy signal and is available to traders within the MT4 platform.

Automated Execution: MT4’s signal service allows users to automate buy and sell orders, setting parameters such as stop-loss and take-profit levels to manage risk and secure gains.

Momentum Signals

Momentum signals capture the strength and direction of price movements, indicating when a currency pair might experience rapid price changes.

Relative Strength Index (RSI): Valutrades MT4 offers RSI-based signals that indicate overbought or oversold conditions. For example, in March 2023, a sell signal was triggered on GBP/USD when the RSI reached 75, suggesting an overbought condition. Following this signal, GBP/USD fell by 1.8% within days.

MACD Signals: Another commonly used momentum indicator on MT4 is the Moving Average Convergence Divergence (MACD). In April 2023, an MACD sell signal on USD/JPY resulted in a 2% decline over a week, illustrating the effectiveness of momentum signals in volatile markets.

Case Studies: Effective Application of Signals in Valutrades MT4

Examining specific trading scenarios provides insights into the effectiveness of signals within the Valutrades MT4 platform. Here are two recent cases illustrating signal-based trading:

Trend Following with Moving Averages on EUR/USD: In Q1 2023, the EUR/USD pair displayed strong upward momentum. Valutrades MT4 generated a buy signal based on a 50-day and 200-day moving average crossover. Traders who entered long positions captured a cumulative gain of 4% as the pair maintained its upward trend. This case highlights how trend-following signals enable traders to ride momentum for extended gains.

RSI-Based Sell Signal on AUD/USD: In August 2023, an RSI-based sell signal was issued for AUD/USD as the RSI reached an overbought reading of 70. Following this signal, AUD/USD declined by 3% over the subsequent week. This case demonstrates the RSI's utility for identifying potential reversals in range-bound or overextended markets.

Practical Strategies for Using Signals on Valutrades MT4

To effectively use trading signals on Valutrades MT4, traders can integrate signals into their strategies. Here are two strategies that incorporate signal-based decision-making:

Trend-Following Strategy

Trend-following strategies aim to capitalize on directional price movements, relying on signals that confirm trend continuation.

Setup: Traders can configure Valutrades MT4 to generate signals based on moving averages or trend indicators. In uptrending markets, traders use buy signals generated by moving average crossovers, while in downtrends, sell signals provide entry points.

Example: During a strong upward trend in Q2 2023, Valutrades MT4 signaled multiple buy entries on EUR/USD. Using these signals, traders entered long positions at each crossover, achieving cumulative gains as the trend continued. By following the trend, traders maximized returns while managing risks with automated stop-loss placements.

Mean Reversion Strategy

Mean reversion strategies are designed to capture profits as prices revert to average levels after overextended movements.

Setup: Valutrades MT4’s RSI and Bollinger Bands signals are well-suited for mean reversion. Traders can configure alerts to trigger buy signals in oversold conditions and sell signals in overbought conditions.

Example: In July 2023, Valutrades MT4 issued a buy signal on USD/CHF as the RSI dropped below 30, indicating oversold conditions. Following this signal, USD/CHF rebounded by 2.5% within a week, exemplifying how mean reversion signals can capitalize on price corrections.

Automating Signal-Based Trading on Valutrades MT4

Valutrades MT4’s platform offers the ability to automate signal-based trading, ensuring swift execution and consistency. Here’s how traders can benefit from automation on MT4:

Signal Integration: By linking signals to automated trading scripts, MT4 users can execute trades immediately upon signal generation. This approach is especially advantageous in volatile markets where delays can impact profitability.

Risk Management Features: Valutrades MT4 enables traders to set predefined stop-loss and take-profit levels on automated trades, ensuring that risk management remains a core component of signal-based strategies. For instance, in April 2023, automated trades on gold triggered by RSI signals capped losses at 1% while securing gains on each positive signal.

Customization: MT4 offers extensive customization options, allowing traders to modify signal parameters, time frames, and entry/exit conditions based on their strategies. Advanced users can incorporate additional technical indicators or customize signals to suit specific market conditions.

User Feedback and Performance Data on Valutrades MT4 Signals

Valutrades MT4 signals have received positive feedback from traders, with many users citing improved trading consistency and reduced emotional biases as primary benefits. Here are some insights gathered from recent data and user reports:

Improved Trading Accuracy: Traders using Valutrades MT4 signals reported a 15% increase in trade accuracy over manual trades, according to a 2023 survey. This improvement is attributed to the objectivity of signal-based trading, minimizing the impact of emotional decisions.

Enhanced Efficiency: Automation options on MT4 have reduced average trade execution time by 30%, allowing traders to capture fast-moving opportunities. In volatile markets, this efficiency has proven beneficial, particularly for scalpers and day traders relying on rapid entries and exits.

Conclusion

Using trading signals on Valutrades MT4 can enhance trading outcomes by providing data-driven insights and supporting automated execution. By applying strategies such as trend-following and mean reversion, traders can effectively capitalize on signals, increasing their chances of success. With Valutrades MT4’s comprehensive features, traders can automate signal-based trades, refine their strategies, and benefit from a systematic approach to forex trading. Through consistent application and customization, trading signals become a powerful tool, allowing traders to navigate the forex market with confidence and precision.

Get expert advice through our free forex signals and elevate your trading strategy!