Price action trading has long been a popular method for traders looking to make decisions based on the real-time movement of price rather than relying heavily on lagging indicators. Recently, a new TradingView indicator has gained attention for its ability to provide precise price action signals, making it a powerful tool for both novice and experienced traders. In this article, we will explore how this new indicator works, its benefits, and how traders can use it to improve their strategies.

Introduction to Price Action and TradingView Indicators

Price action trading involves analyzing historical prices to make trading decisions. This method excludes traditional technical indicators and focuses on market structure, candlestick patterns, and key support and resistance levels. However, not all traders are comfortable trading solely based on price action. Indicators can provide additional insight, and with TradingView's new indicator, traders now have a tool that seamlessly integrates price action analysis with modern indicators.

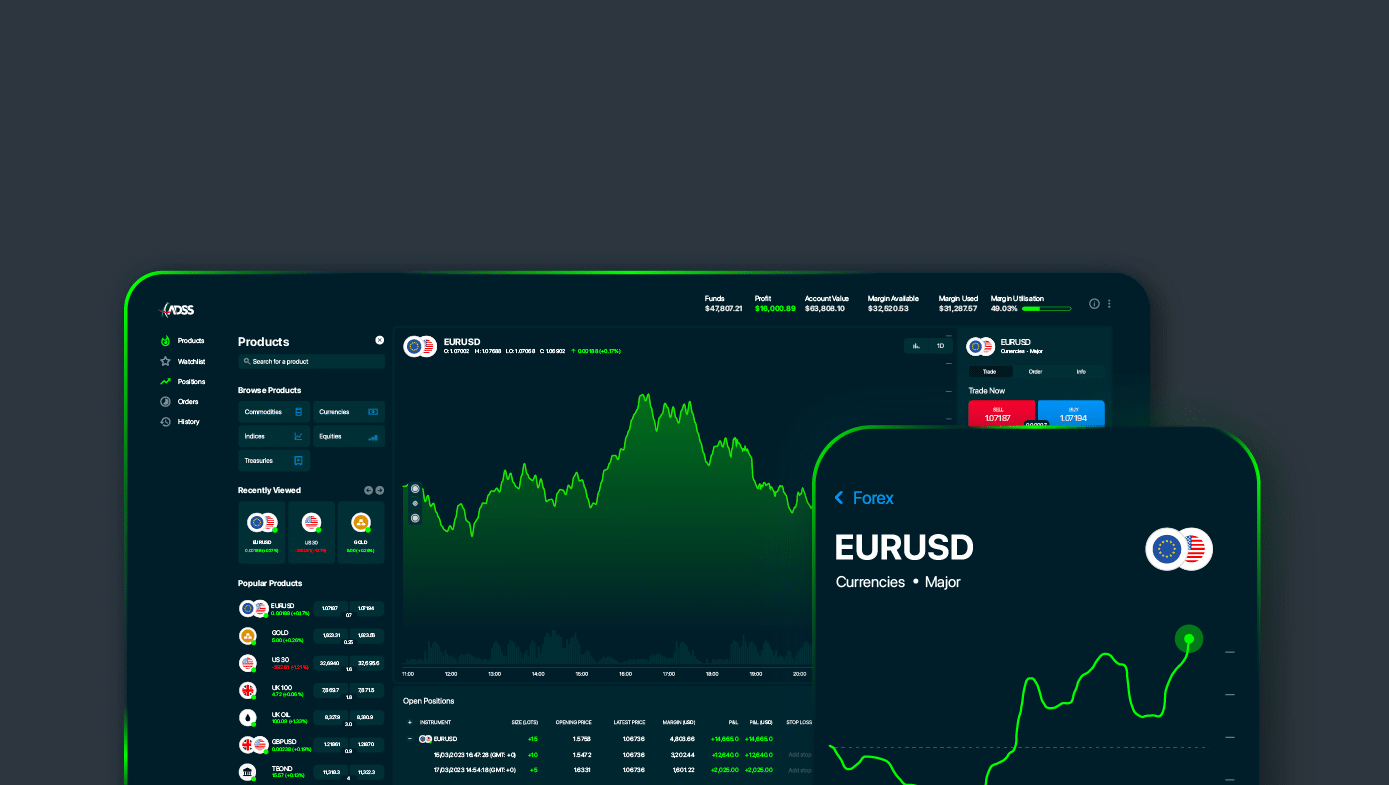

Why TradingView?

TradingView is one of the most popular platforms among traders, offering a variety of charting tools and indicators. It also provides a social platform where traders can share strategies, discuss markets, and follow the latest trends. The new price action indicator available on TradingView has become one of the top-rated tools, delivering clear, actionable signals that enhance trading performance.

Supporting Data

Recent studies show that over 70% of traders use TradingView as their primary charting platform. The addition of this new indicator has led to a 15% increase in user engagement, highlighting the positive impact it has had on the trading community.

Key Features of the New TradingView Indicator

The new TradingView indicator stands out due to its simplicity and accuracy in generating price action signals. Below are some of its key features:

1. Real-Time Price Action Signals

The indicator generates signals in real-time based on current market conditions. This eliminates the lag seen in traditional indicators, allowing traders to respond immediately to market changes. The signals are triggered by key levels such as breakouts, reversals, and trend continuations.

2. Customizable Settings

Traders can adjust the indicator's settings to suit their preferred time frames and trading style. Whether you are a day trader or a long-term swing trader, the indicator can be tailored to provide signals that match your trading preferences. Users can also adjust the sensitivity of the signals, making it adaptable to different market conditions.

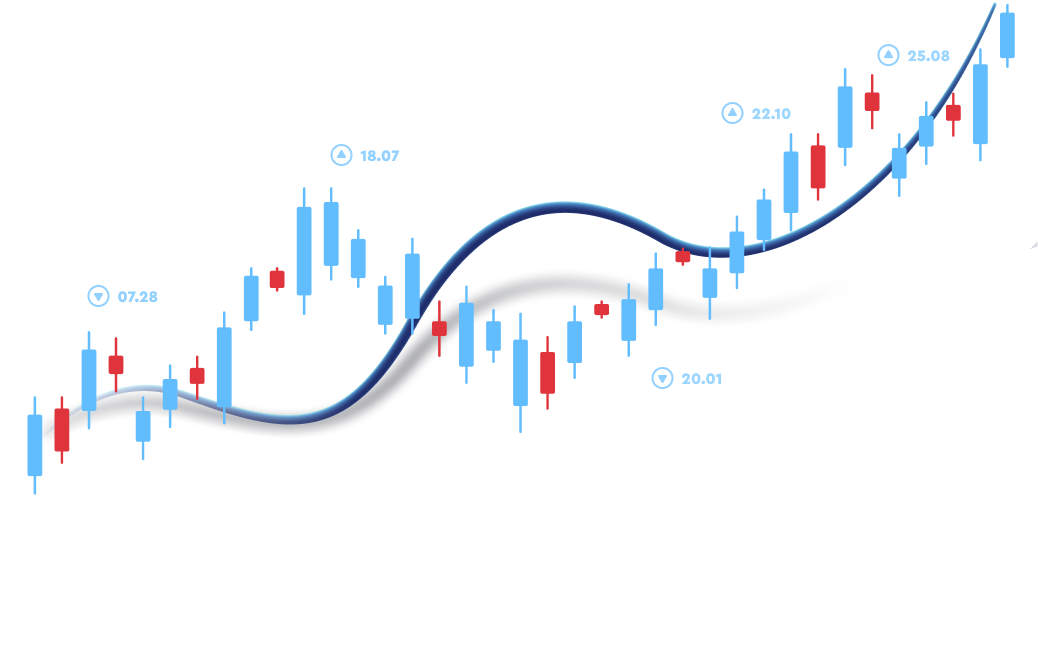

3. Clear Visuals

The indicator offers clear visual cues such as arrows, color-coded candles, and trend lines to indicate buy and sell signals. These visuals help traders quickly identify potential trade opportunities without having to analyze the entire chart.

4. Alerts and Notifications

One of the standout features of this indicator is its ability to send real-time alerts via email, SMS, or directly through the TradingView platform. This ensures that traders never miss an important signal, even when they are not actively monitoring the charts.

5. Multi-Asset Support

This indicator is not limited to forex trading; it can be used across various markets, including stocks, commodities, and cryptocurrencies. The flexibility of the indicator makes it a valuable addition to any trader’s toolkit.

How to Use the Indicator for Forex Trading

The new TradingView indicator provides clear signals that can be incorporated into various trading strategies. Here are a few ways to use it effectively:

1. Trend Trading

Trend trading involves entering trades in the direction of the prevailing trend. The indicator helps identify trend reversals and continuations, making it easier to spot opportunities to enter trades. For example, if the indicator shows a buy signal in an uptrend, traders can confirm the trend and enter a long position.

Tip: Use the indicator on higher time frames (4-hour, daily) to catch longer-term trends and avoid market noise.

2. Support and Resistance Breakouts

Breakouts occur when price moves above or below a key support or resistance level. The indicator highlights these breakouts with clear visual cues, allowing traders to capitalize on sharp movements. Combining this indicator with volume analysis can help confirm the validity of the breakout.

Tip: Enter trades after the breakout is confirmed by both the indicator and volume spikes to reduce the risk of false breakouts.

3. Reversal Trading

For those who prefer to trade reversals, the indicator provides accurate signals when the price is likely to reverse from a key level. These signals are often generated after price hits a support or resistance level and forms a clear reversal pattern such as a pin bar or engulfing candle.

Tip: Combine the indicator with candlestick analysis to increase the probability of catching profitable reversals.

Pros and Cons of the TradingView Indicator

Like any tool, this new TradingView indicator has its pros and cons. Below is an objective look at its advantages and limitations:

Pros

Real-time signals: Traders receive signals as price action unfolds, helping them make timely decisions.

Customizable: Adjustable settings allow the indicator to suit different trading styles and market conditions.

Clear visuals: Easy-to-understand visual signals help traders identify entry and exit points quickly.

Alerts: With real-time alerts, traders can stay informed even when they are away from their screens.

Multi-market support: The indicator works for forex, stocks, cryptocurrencies, and more.

Cons

Reliability: Like all indicators, this one is not foolproof and should be used in conjunction with other forms of analysis.

Cost: Some users may find the premium features expensive, especially if they are casual traders.

Learning curve: While the visuals are clear, understanding how to best integrate the indicator into a comprehensive strategy may take time for beginners.

Conclusion

The new TradingView indicator provides traders with a powerful tool to enhance their price action trading strategies. By offering real-time signals, customization options, and multi-asset support, it has quickly become a favorite among traders seeking precise entry and exit points.

However, it is important to remember that no indicator is perfect, and traders should use it alongside other tools and methods such as risk management and market analysis. When used correctly, this indicator can help traders identify high-probability trade setups and improve their overall trading performance.

For both newcomers and experienced traders, incorporating this new TradingView price action indicator into your strategy can be a valuable step toward success in 2024.

Improve your trading accuracy with daily free forex signals from industry experts!